Pnb Fixed Deposit Rates

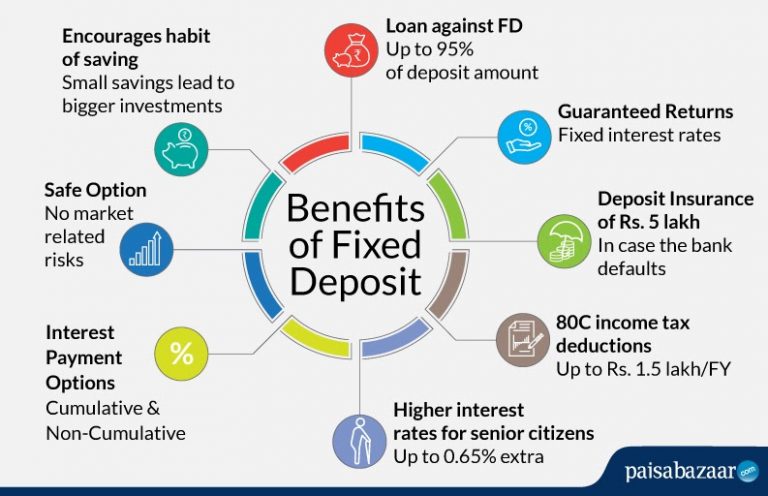

We know that everyone wants to save the amount they have. Sometimes, they want to keep, but due to some issues, they need to spend a particular amount. That is the reason most of the banks started providing attractive interest rates on opening fixed deposits account with them. It means you cannot break the bond or account until the Tenure. In this way, you can keep your money safe. Therefore, we will be talking about PNB fixed deposit rates.

Punjab National Bank Fixed Deposit Interest Rates:

The interest rate depends upon the Tenure you pick and how old are you? It means if you come under the senior citizen scheme, then probably you’ll be getting more interest rates on opening fixed deposit account with Punjab national bank. Anyway, let me tell you about the interest rates based on different scheme, Tenure and group of people.

One can use the Paisabazaar FD Calculator free of cost to determine the interest he/she may earn through the entire tenure at the applicable post office fixed deposit rates. The tool requires deposit amount, tenure (in months or years) and the current Post office fixed deposit interest rate for the chosen tenure. PNB Revised Rates of FD Punjab National Bank has revised its FD rates effective from February 17, 2020. The interest rates for 7 to 45 days are 4.50%, for 46 to 179 days it is 5% and 180 days to less than 1 year it is 5.75%. The rate for long tenures such as 1 year and up to 10 years is 6.05%. Punjab National Bank (PNB) FD Rates 2021 Updated on February 11, 2021, 12130 views. Punjab National Bank (PNB) offers competitive Fixed Deposit interest rates and a wide range of other benefits such as flexible tenure options, nomination Facility, loan/overdraft option, etc. Fixed Deposit of FD refers to an investment avenue which is generally offered by banks and post office. Fixed Term Deposit Rates - USD and Peso Learn more about PNB Singapore's products and services. PNB Singapore will be happy to serve you BY APPOINTMENT on Saturdays, Sundays, and public holidays, starting June 13, 2020. Jan 28, 2021 Fixed Deposit Interest Rates in India - Important Terms Timely Closure: It refers to the closure of your FD account at the time it matures. When you close your fixed deposit account on its maturity date, the bank pays you back the principal amount with the interest that you have accumulated during the term chosen.

- PNB Short Term FD Rates

- PNB Medium Term FD Rates

- PNB long term FD rates

- PNB FD Rates for senior citizen

#1 PNB Short Term FD Rates

You need to know that the rate of interest you’ll be getting for choosing short term deposits are something near about 4.50% to 6.60% P/A. It is for 7 Days to 1 Year Tenure.

#2 PNB Medium Term FD Rates

You need to know that the rate of interest you’ll be getting for choosing medium-term deposits are something near about 6.50% to 6.60% P/A. It is for 1 Year to 5 Years Tenure.

#3 PNB Long Term FD Rates

You need to know that the rate of interest you’ll be getting for choosing long-term deposits are something near about 6.50% P/A. It is for more than 5 Years Tenure.

#4 PNB FD Rates for senior citizen

The interest rates for senior citizen fixed deposit account is around 7% P/A in Punjab national bank. It is usually 0.50% more than regular FD interest rates.

Read More – Canara Bank Net Banking Login Guide

How to Open the PNB Fixed Deposit Account?

You can open Punjab national bank fixed deposit account for Rs 25000 or more. You can open either by visiting the bank following traditional and old method or via internet banking of Punjab national bank. Both of the options are perfect, and there is no difference in interest rates on both of the methods.

Frequently Asked Questions:

Fixed Deposit Rates Singapore

There are some questions which are frequently asked by the customers related to PNB Fixed Deposits account. Let me clear some of the queries here itself.

- Do interest rates change on Term Deposits from time to time?

- Do you need to pay the tax on the interest?

- What are the consequences if you have not provided your PAN card?

- How is interest paid to term deposit holder?

- Is the interest rate same on e-FD and regular FD?

#1 Do interest rates change on Term Deposits from time to time?

Yes, it depends upon the bank, and they can change the rate of interest anytime. However, you’ll be getting the same rate of interest, in which you have opened your FD account.

#2 Do you need to pay tax on the interest?

Yes, you need to pay tax on the interest you earn if the interest is more than Rs 10000 per financial year.

#3 What are the consequences if you have not provided your PAN card?

If you have not provided your PAN card while opening FD account, then you’ll be charged more TDS rate. You will not receive the TDS certificate, and you cannot claim your TDS credit from the income tax department. It is better to provide PAN card copy while opening a fixed deposit account with PNB.

#4 How is interest paid to term deposit holder?

The interest a customer earns during the Tenure of their fixed deposit account will automatically get credited to their linked savings bank account.

#5 Is the interest rate same on e-FD and regular FD?

Yes, the interest rates are the same on e-FD and regular FD. There is no difference. The only difference is in the process of opening the FD account.

Conclusion:

Punjab national bank is one of the widest and leading banks of India. This bank is giving fierce competition to other government banks by providing attractive interest rates on opening a fixed deposit account with them. In this post, we have added all the required details you need to know about Punjab national bank fixed deposits. If there is anything else to ask, then you can ask us in the comments section related to this article.

Hey, this is Johny Sehgal. I am the owner and caretaker at Finance Jungle. I completed my education in BSC and now heading towards the digital marketing industry. I usually have interests in reading, playing games and watching movies. I also love to write content based on quality information. The main motive of mine is to provide the top and best quality information to my readers. Finance Jungle is the blog for the same.

© Jocelyn Fernandes Fixed Deposit rates: Check out FD interest rates in SBI, ICICI Bank, HDFC Bank PNB and Axis BankFor tenures ranging from 7 days to 10 years, top banks like State Bank of India (SBI), HDFC Bank, Punjab National Bank (PNB), ICICI Bank and Axis Bank offer fixed deposits (FDs). Before parking your money any FD deposit, it's always important to compare the FD interest rates offered by various banks.

This month SBI and Axis Bank revised the interest rates on term deposits. Check out the latest fixed deposit rates in SBI, ICICI Bank, HDFC Bank, PNB and Axis Bank.

FD interest rates SBI (below Rs 2 crore) effective January 8, 2021:

SBI FDs between seven to 45 days will now fetch 2.9 percent. Term deposits between 46 days to 179 days will give 3.9 percent. FDs of 180 days to less than one year will fetch 4.4 percent. Deposits with maturity between 1 year and up to less than 2 years will give 10 bps more now. These deposits will fetch an interest rate of 5 percent instead of 4.9 percent. FDs maturing in 2 years to less than 3 years will give 5.1 percent. FDs with 3 years to less than 5 years will offer 5.3 percent and term deposits maturing in 5 years and up to 10 years will continue giving 5.4 percent after the latest revision.

Days

Interest rates

7 days to 45 days

2.9%

46 days to 179 days

3.9%

180 days to 210 days

4.4%

211 days to less than 1 year

4.4%

1 year to less than 2 years

5%

2 years to less than 3 years

5.1%

3 years to less than 5 years

5.3%

5 years and up to 10 years

5.4%

FD interest rates Axis Bank (below Rs 2 crore) effective January 4, 2021:

Across different tenures, Axis Bank offers FDs ranging from 7 days to 10 years. The bank gives interest on FDs ranging from 2.5 percent to 5.50 percent for general customers. On select maturities, Axis Bank offers a higher interest rate to senior citizens. The bank offers interest ranging from 2.50 percent to 6 percent to senior citizens.

Days

Interest rates

7 days to 29 days

2.5%

30 days to 90 days

3%

90 days to 120 days

3.5%

120 days to 180 days

3.75%

180 days to 360 days

4.40%

2 years to less than 3 years

5.4%

3 years to less than 5 years

5.4%

5 years and up to 10 years

5.5%

FD interest rates Punjab National Bank (below Rs 2 crore) effective January 1, 2021:

On fixed deposits maturing in the range of 7 days to 10 years, PNB is offering an interest rate ranging between 3 percent and 5.30 percent. On 7-45 days fixed deposits, PNB is offering an interest rate of 3 percent and it goes up 4.5 percent on less than 1 year FDs. PNB gives 5.20 percent interest on term deposits maturing in one year to up to 3 years. On deposits maturing above 5 years to 10 years, PNB is offering 5.30 percent interest. The Senior citizens shall get an additional rate of interest of 50 bps over applicable card rates for all maturities on domestic deposits of less than Rs 2 crore.

Days

Interest rates

7 days to 45 days

3%

46 days to 90 days

3.25%

91 days to 179 days

Pnb Fixed Deposit Rates For 1 Year

4%

180 days to 270 days

4.4%

271 days to less than 1 year

4.5%

1 year to 3 years

5.2%

3 years to 5 years

5.3%

5 years and up to 10 years

5.3%

FD interest rates HDFC Bank (below Rs 2 crore) effective from November 13, 2020:

On deposits between 7 days and 29 days, HDFC Bank offers a 2.50 percent interest rate. 3 percent on deposits maturing in 30-90 days. On 91 days to 6 months, 3.5 percent and on 6 months 1 day to less than one year, 4.4 percent. The bank gives 4.9 percent on FDs maturing in one year. Term deposits maturing in one year and two years will fetch an interest rate of 4.9 percent. FDs maturing in 2 years to 3 years will give 5.15 percent, 3 years to 5 years will give 5.30 percent. Deposits with a maturity period of 5 years to 10 years will give 5.50 percent interest.

Days

Interest rates

7 days to 29 days

2.5%

30 days to 90 days

3%

Fixed Deposit Rates Dbs

91 days to 179 days

3.5%

180 days to 365 days

Pnb Fixed Deposit Rates For 1 Year

4.4%

365 days to less than 2 years

Pnb Fixed Deposit Rates December 2020

4.9%

2 years to 3 years

5.15%

3 years to 5 years

5.3%

5 years and up to 10 years

5.5%

FD interest rates ICICI Bank (below Rs 2 crore) effective from October 21, 2020:

ICICI Bank gives 2.5 percent interest on deposits maturing in 7 days to 29 days, 3 percent for 30 days to 90 days, 3.5 percent for FDs maturing in 91 days to 184 days. On deposits maturing in 185 days to less than 1 year, ICICI Bank gives an interest rate of 4.40 percent. Term deposits maturing in 1 year to less than 18 months will fetch an interest rate of 4.9 percent. Now, FDs with tenure of 18 months to 2 years will give you 5 percent interest. Term deposits maturing in 2 years to 3 years will give 5.15 percent, 3 years to 5 years 5.35 percent, and 5 years to 10 years 5.50 percent.

Days

Interest rates

7 days to 29 days

2.5%

30 days to 90 days

3%

91 days to 184 days

3.5%

185 days to 365 days

4.4%

1 year to less than 1.5 years

4.9%

1.5 years to 2 years

5%

2 years to 3 years

5.15%

3 years and up to 5 years

5.35%

5 years to 10 years

5.5%