Time Deposit Account

The BANK may close an account any time without prior notice to the Depositor, if the deposit balance becomes zero, due to collection of service charges by the BANK or withdrawal by the Depositor, or for violation of existing rules and regulations of the BANK, the Bangko Sentral ng Pilipinas, Anti-Money Laundering Council, Bankers’ Association. In fact, Marcus guarantees that you'll receive the highest rate it offers on a CD within 10 days of opening an account, as long as you deposit $500 during that time.

- Stepping up your savings is the key to achieving a comfortable life. Don’t just settle for a basic savings account. Grow your money faster with a BDP Peso Time Deposit. Visit a branch near you today.

- If you have just started to consider investing, putting your funds in a time deposit account is a good way to start. BDO Time Deposit offers you that advantage by giving you a wide range of peso and dollar time deposit options that fits your lifestyle and saving goals.

A time deposit or term deposit (in the United States also known as a certificate of deposit) is a deposit in a financial institution with a specific maturity date or a period to maturity, commonly referred to as its “term”. Time deposits differ from at call deposits, such as savings or checking accounts, which can be withdrawn at any time, without any notice or penalty. Deposits that require notice of withdrawal to be given are effectively time deposits, though they do not have a fixed maturity date.

Unlike a certificate of deposit and bonds, a time deposit is generally not negotiable; it is not transferable by the depositor, so that depositors need to deal with the financial institution when they need to prematurely cash out of the deposit.

Time deposits enable the bank to invest the funds in higher-earning financial products. In some countries, including the United States, time deposits are not subject to the banks’ reserve requirements, on the basis that the funds cannot be withdrawn at short notice. In some countries, time deposits are guaranteed by the government or protected by deposit insurance.

Interest[edit]

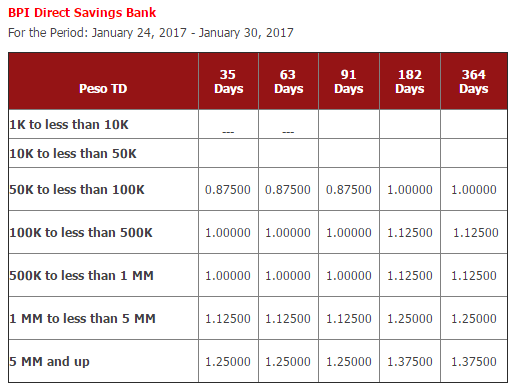

Time deposits normally earn interest, which is normally fixed for the duration of the term and payable upon maturity, though some may be paid periodically during the term, especially with longer-term deposits. Generally, the longer the term and the larger the deposit amount the higher the interest rate that will be offered.[1]

The interest paid on a time deposit tends to be higher than on an at-call savings account, but tends to be lower than that of riskier products such as stocks or bonds. Some banks offer market-linked time deposit accounts which offer potentially higher returns while guaranteeing principal.

At maturity[edit]

At maturity, the principal can be either paid back to the depositor (usually by a deposit into a bank account designated by the depositor) or rolled over for another term. Interest may be paid into the same account as the principal or to another bank account or rolled over with the principal to the next term.

The money deposited normally can be withdrawn before maturity, but a significant penalty will normally be payable.

See also[edit]

References[edit]

- ^'Time Deposit'. Investopedia. 2003-11-24. Retrieved 2016-11-01.

What Is A Current Account?

A current account is for use by sole proprietors, companies, partnerships, associations, trusts, etc. to make current transactions. All business transactions are conducted through a current account. A current account does not have an end or maturity date.

What Is A Deposit Account/Savings Account?

A savings account is a basic deposit account for an individual to carry out day-to-day transactions and withdrawals. A deposit account can be held individually or jointly by two or more people. A savings account does not have an end or maturity date as well.

Difference Between Current Account And Deposit Account

Some of the differences between a current account and a deposit account are:

- Interest

Interest applies to the minimum balance available in a deposit account. The interest is applicable on the minimum account balance, every day. Banks offer interest rates of 4% or more on savings accounts. Current accounts, on the other hand, are non-interest accounts. There is no interest for any balance in a current account. Although, this may change in the future.

- Transaction rates

Time Deposit Account Meaning

Transaction rates apply for withdrawals made over the limit of free withdrawals (usually 3-5) made in deposit accounts. Thus, a savings account holder will have to pay the transaction rate applicable by the bank (eg: INR 20, 25, 50, 90, etc.). Conversely, there are no transaction rates applicable on current accounts. Businesses transact more than individuals and thus, there is no transaction rates or limits on current accounts.

- Minimum balance

Time Deposit Example

Deposit account-holders must maintain a daily average minimum balance in their account. This amount varies from bank to bank and some banks even offer zero-balance deposit/savings accounts. In this case, current account-holders also must maintain a minimum balance in their bank accounts. The minimum balance required for a current account is much higher than the minimum balance required for deposit accounts.

- Overdraft facility

Deposit Account Regulations

Deposit account-holders can only withdraw what balance is in their saving account. Banks do not offer overdraft facilities on saving accounts unless the customer is a salaried account-holder (approved companies). Whereas, current account-holders can withdraw over and above the balance in an account. Overdraft facilities help businesses to make up cash flows when there is a shortage of funds. Interest is applicable to the overdraft amount taken.